Investing in apartments

Everyone needs a place to live. With the rapid rise in housing prices, home ownership is becoming increasingly difficult and renting has become a realistic lifestyle choice for many Canadians. This, paired with strong global immigration to Ontario, has led to an increase in demand for apartment units and low vacancy rates.

Smarter Diversification

You can diversify outside of public markets with private real estate, allowing you to reduce risk and improve stability. Relative to a traditional portfolio composed of 60-70% large-cap stocks and 30-40% bonds, a portfolio which includes some allocation to private real estate has historically shown the ability to drive higher returns, with generally more annual income and lower volatility over the past 20 years

Consistent Historical Income Generation

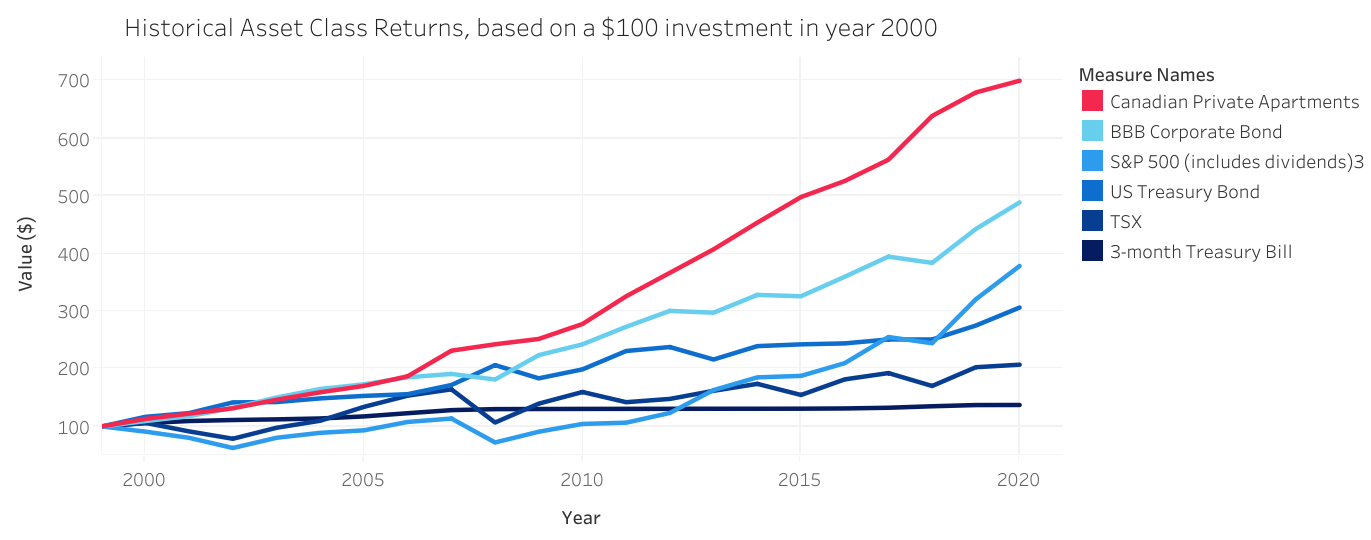

Real estate has a well-earned reputation for being a reliable source of passive income. Private real estate performance has averaged a higher rate of return than the yields of other major asset classes. The graph below represents the value of $100 invested over the past 20 years

Resilient to Economic Distress

Returns on Private Canadian Apartments’ have been significantly less volatile than the returns associated with Canadian, Global, US and Emerging Market Equities' of the last 32 years. The size of the bars in this graph represents the range of annual returns recorded by each of the asset classes over the last 32 years. Private Canadian Apartments have never had a negative year even during the last four financial crises.